How To Create Opportunity Zone Fund

Key takeaways:

- The 2017 Tax Cuts and Jobs Act established the Qualified Opportunity Zone program to provide a tax incentive for private, long-term investment in economically distressed communities.

- Investors in these programs are given an opportunity to defer and potentially reduce tax on recognized capital gains.

- Tax savings are only available when investors retain the investment in the Qualified Opportunity Fund for the time frame stated.

What this may mean for you:

- If you are facing a significant tax liability as a result of capital gains, investing in a Qualified Opportunity Fund may be worth exploring, provided you invest within a prescribed amount of time.

Download the report (PDF)

What is an Opportunity Zone?

An Opportunity Zone is a community nominated by the state and certified by the Treasury Department as qualifying for this program. The Treasury Department has certified zones in all 50 states; Washington, D.C.; and U.S. territories.

There are approximately 8,700 Opportunity Zones nationwide. A list can be found at the U.S. Department of Housing and Urban Development.

How does this program work?

To defer a capital gain (including net §1231 gains), a taxpayer has 180 days from the date of the sale or exchange of appreciated property to invest the realized capital gain dollars into a Qualified Opportunity Fund. The fund then invests in Qualified Opportunity Zone property.

The taxpayer may invest the return of principal as well as the recognized capital gain, but only the portion of the investment attributable to the capital gain will be eligible for the exemption from tax on further appreciation of the Opportunity Zone investment, as explained below. The Opportunity Zone program allows for the sale of any appreciated assets, such as stocks, with a reinvestment of the gain into a Qualified Opportunity Fund. There is no requirement to invest in a like-kind property to defer the gain.

Note that a taxpayer who receives a reported capital gain from a flow-through entity, such as a partnership, an S-corporation, or a trust/estate, has 180 days from the end of the calendar year to make an investment in a Qualified Opportunity Fund, regardless of how early in the calendar year the entity itself realized its gain. For example, if a partnership entity realized a capital gain in March, each partner's 180-day triggering date will be December 31 of the same year and each partner will have until approximately June 28 of the following year to make their Qualified Opportunity Zone investment.

Qualified Opportunity Fund

A Qualified Opportunity Fund is any investment vehicle that is organized as a corporation or a partnership for the purpose of investing in Qualified Opportunity Zone property (other than another Qualified Opportunity Fund) that holds at least 90% of its assets in Qualified Opportunity Zone property.

Similar to other investments, an investment in a Qualified Opportunity Fund may increase or decrease in value over the holding period. In addition, income may be paid on this investment. Given that the purpose of the program is to improve particular areas, it is expected that the fund will continue to invest in the improvement of the property in which it is invested. Cash flow may occur once the property improvements are complete and the property is leased or sold to third parties.

Because Qualified Opportunity Funds are new income tax planning tools and are new investment options for taxpayers, these investments may involve risk. Like many other types of investments, the risks may potentially include market loss, liquidity risk, and business risk, to name just a few. Because this investment may not be appropriate for all investors, consult with your investment advisor before pursuing such an investment to determine if this fits with your risk profile and diversification of your investments.

Qualified Opportunity Zone property

Qualified Opportunity Zone property is used to refer to property that is a Qualified Opportunity Zone stock, a Qualified Opportunity Zone partnership interest, or a Qualified Opportunity Zone business property acquired after December 31, 2017, used in a trade or business conducted in a Qualified Opportunity Zone or ownership interest in an entity (stock and partnership interests) operating with such tangible property.

Conceptually, the Qualified Opportunity Fund must bring property new to the entity to be used in the Opportunity Zone. A fund that simply acquires property already being used in the zone will not qualify without substantial improvement. Substantial improvement requires improvements to exceed the Qualified Opportunity Fund's initial investment into the existing property over a 30-month period. (Note: investment only applies to the amount paid for the building)

For instance, if a Qualified Opportunity Fund acquires existing real property in an Opportunity Zone for $1 million, the fund has 30 months to invest an amount greater than the $1 million purchase price for improvements to the property in order to qualify for this program. Certain businesses, such as golf courses, country clubs, massage parlors, hot tub facilities, suntan facilities, race tracks or other facilities used for gambling, and liquor stores, are prohibited for Qualified Opportunity Fund investments.

Tax deferral and savings

A Qualified Opportunity Fund investment provides potential tax savings in three ways:

Tax deferral through 2026 - A taxpayer may elect to defer the tax on some or all of a capital gain if, during the 180-day period beginning at the date of sale/exchange, they invest in a Qualified Opportunity Fund. Any taxable gain invested in a Qualified Opportunity Fund is not recognized until December 31, 2026 (due with the filing of the 2026 return in 2027), or until the interest in the fund is sold or exchanged, whichever occurs first. In addition, the deferred gain can be further reduced as described below.

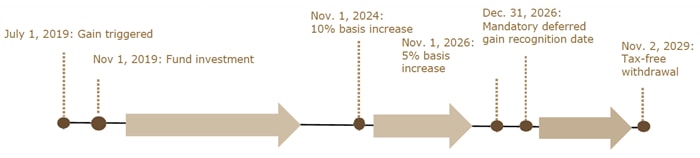

Step-up in tax basis of 10% or up to 15% of deferred gains - A taxpayer who defers gains through a Qualified Opportunity Fund investment receives a 10% step-up in tax basis after five years and an additional 5% step-up after seven years. Note that to take full advantage of the 15% step-up in tax basis, the taxpayer must have invested by December 31, 2019. When the tax is triggered at the end of 2026, the taxpayer will have held the investment in the fund for seven years, thereby qualifying for the 15% increase in tax basis.

No tax on appreciation - Remaining in the Qualified Opportunity Fund for at least 10 years results in the cost basis of the property being equal to the fair market value on the date of sale/exchange.

- Tax deferral through 2026

The gain deferral applies to any investment gain (for example, the sale of appreciated stock or a business). It is important to note that the tax cannot be deferred indefinitely — only until 2026. The tax savings, however, may still be significant. Qualifying for deferral does not require an intermediary, and the taxpayer has 180 days from a sale to invest the gains into a Qualified Opportunity Fund.Example 1: In July 2019, a taxpayer sells a zero-basis business for $10 million, resulting in a $10 million capital gain. The taxpayer invests the entire amount in a Qualified Opportunity Fund within 180 days. None of the sale proceeds are taxable in 2019. At current federal capital gains rates, this allows the taxpayer to keep over $2 million that would otherwise have been taxed as a capital gain (based on the current IRS rate of 20%) and paid in the 2019 tax year and instead invest it in the Qualified Opportunity Fund. Assuming even a conservative rate of return on that $2 million, it could provide a significant return to the taxpayer over the length of the investment.

- No tax on 10% or up to 15% of deferred gains

Example 2: Given the same situation as the previous example, after five years, the taxpayer is given a $1 million basis in the fund (10% of the original capital gain deferred). After seven years, the taxpayer is given another $500,000 of basis in the fund (5% of the original capital gain deferred). After seven years, hypothetically the taxpayer sells the $10 million investment and would pay tax on only $8,500,000 of the gain. At current federal capital gains rates, that's a savings of over $300,000 simply for holding the investment for seven years.

- Investing in a Qualified Opportunity Zone in 2021

As stated above, the combined application of the "five-year, 10% basis increase" and the "seven-year, 5% basis increase" necessitate that a taxpayer's gain be triggered and a subsequent Qualified Opportunity Zone investment all must occur prior to the end of 2019. However, the "five-year, 10% basis increase" is still available for taxpayers through December 31, 2021.Example 3: Assume similar facts as above, in Example 1 and Example 2, except the dates have been changed: July 2021, a taxpayer sells a zero-basis business for $10 million, resulting in a $10 million capital gain. The taxpayer invests the entire amount in a Qualified Opportunity Fund within 180 days, on November 1, 2021. None of the sale proceeds are taxable in 2021. On November 1, 2026, the taxpayer receives a 10% adjustment to their cost basis in the Qualified Opportunity Zone investment, amounting to $1 million. On December 31, 2026, the taxpayer must recognize the deferred gain on the sale of the investment, and their cost basis for determining the total gain is $1 million. Assuming that the overall value of the Qualified Opportunity Zone investment has not decreased, then the taxpayer will pay the capital gain on $9 million (that is, the $10 million 2021 gain reduced by the five-year 10% basis adjustment of $1 million), and the taxpayer must reflect that gain on their 2026 federal income tax return, to be filed in 2027. With the dates changed, the taxpayer misses the additional 5% basis adjustment because the seven-year anniversary is not attainable before the December 31, 2026, gain recognition date.

What if there is a loss in value in the Qualified Opportunity Fund?

The taxpayer is still eligible for the increase in basis for holding the investment for five or seven years. The taxpayer's recognized gain for 2026 (or the year of divesting from the fund) will be the lesser of the original deferred gain or the fair market value of the fund interest reduced by the taxpayer's adjusted basis in the fund, if any. Because of the complicated nature of these investments and the complicated rules that are associated with it, please consult your tax advisor before committing any funds.Example 4: Again, given the same situation, after seven years, the Qualified Opportunity Zone property is sold at a loss. Let's presume the taxpayer realizes $8 million from the Qualified Opportunity Fund (80% of the original investment). Because the taxpayer held the investment for seven years, the taxpayer receives a 15% increase in basis, or $1,500,000. The gain realized would be $6,500,000 ($8,000,000 - $1,500,000).

- Potentially no tax on appreciation

Example 5: In 2019, a taxpayer makes a $10 million investment in a Qualified Opportunity Fund. In 2030, the taxpayer sells the investment for $15 million. The $5 million in appreciation is not taxable. At current federal capital gains rates, that's a savings of over $1 million. The taxpayer will, however, have phantom income (taxable income without corresponding sale) on the original $10 million investment in 2027 for the 2026 tax year because the investment in the fund was held beyond December 31, 2026, when the deferred gain on the original investment must be recognized.

Conclusion

Qualified Opportunity Funds remain an option for deferral of capital gains as long as you are able to retain the investment for the noted time frames. Keep in mind that depending on potential tax legislation, capital gains rates at the time of sale or 2026 could be a higher rate than in 2021. Taxpayers should seek the advice of their professional legal and tax counselors when considering a Qualified Opportunity Zone investment.

How To Create Opportunity Zone Fund

Source: https://www.wellsfargo.com/the-private-bank/insights/planning/wpu-qualified-opportunity-zones/

Posted by: waterswittionfer93.blogspot.com

0 Response to "How To Create Opportunity Zone Fund"

Post a Comment